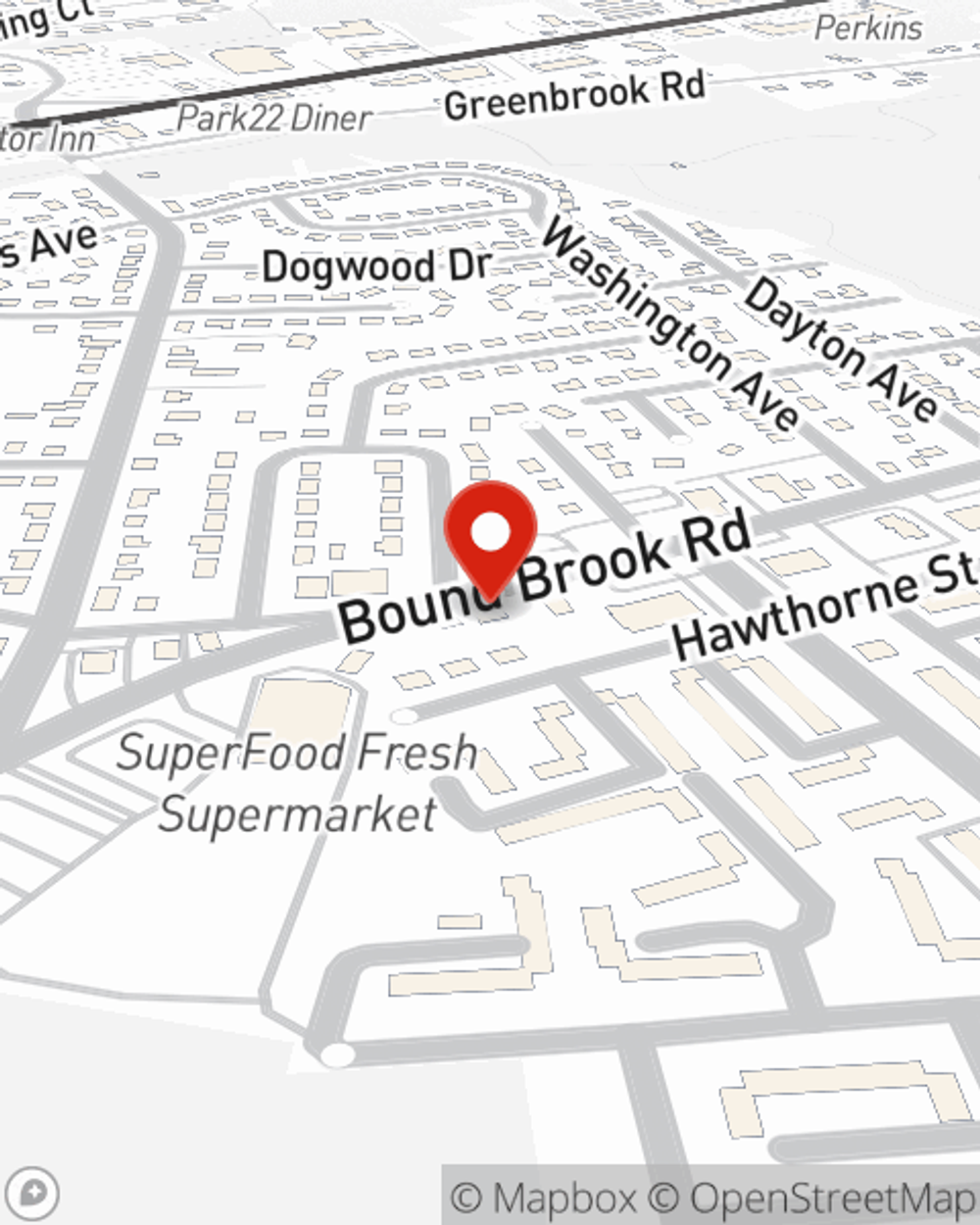

Business Insurance in and around Middlesex

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- Middlesex

- Somerset County

- Branchburg

- Middlesex County

- New Brunswick

- Pennsylvania

- New Jersey

- New York

- Newark

- Bound Brook

- Warren

- Watchung

- Green Brook

- Bridgewater

- Somerville

- Raritan

- Piscataway

- Dunellen

- North Brunswick

- Hillsborough

- Edison

- Plainfield

- Perth Amboy

Insure The Business You've Built.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Allison Roy help you learn about quality business insurance.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a tailoring service or a painter or you own an acting school or a donut shop. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Allison Roy. Allison Roy is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

At State Farm agent Allison Roy's office, it's our business to help insure yours. Contact our terrific team to get started today!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Allison Roy

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.